So, are you running a healthy, profitable professional services organisation (PSO)?

Most of us will know when the year or month is over after we settle the accounts and review our profits and losses.

But while the P&L analysis is essential for any business, when you are in the people-powered professional services industry, there’s a specific set of KPIs you need to keep an eye on profitability throughout the year.

This article provides the KPIs with the highest impact on your business finances, which you need to run a successful and profitable professional services business or embedded PSO.

The 7 KPIs crucial to any PSO's finances

Working with hundreds of PSOs (professional services organisations), we have identified the most common 7 KPIs with the highest impact on your business finances. Time tracking is the foundation for any PSO's operational KPIs.

While overall revenue and profit figures are undoubtedly relevant for any business, they are not included in this list.

Instead, we have included operational KPIs with direct financial impact, as these are the nuts and bolts you can tweak to tune your bottom line.

We have also included what you should be cautious about when using these KPIs as a management tool and their formulas.

So, let's get started. This first one is an oldie but goldie.

1 - Billability % (or billable utilisation %)

This KPI tells you how much of your consultants' time you can bill your clients.

While some PSOs primarily look at their consultants' general utilisation percentage, this is not the same, as billability percentage replaces productive time with billable time.

You might say that you shift focus from whether your consultants are busy to whether their time is, in fact, profitable.

For instance, a consultant might increase his or her utilization percentage while working on a client project. But if he or she spends more time on the project than you can bill the client, the billable utilization drops.

It's essential to keep track of this KPI, as this KPI is directly related to your consultants' profitability.

This KPI is easy to track on time and material agreements. For these agreements, the billability percentage is 1-1, equivalent to what you can invoice the client relative to your total working time.

You need to use your budgeted hours to calculate fixed-price or retainers.

Caution:

As with utilization %, a narrow focus on billability % can lead your consultants to neglect important but non-billable tasks, such as competency development, project evaluation, team building, etc.

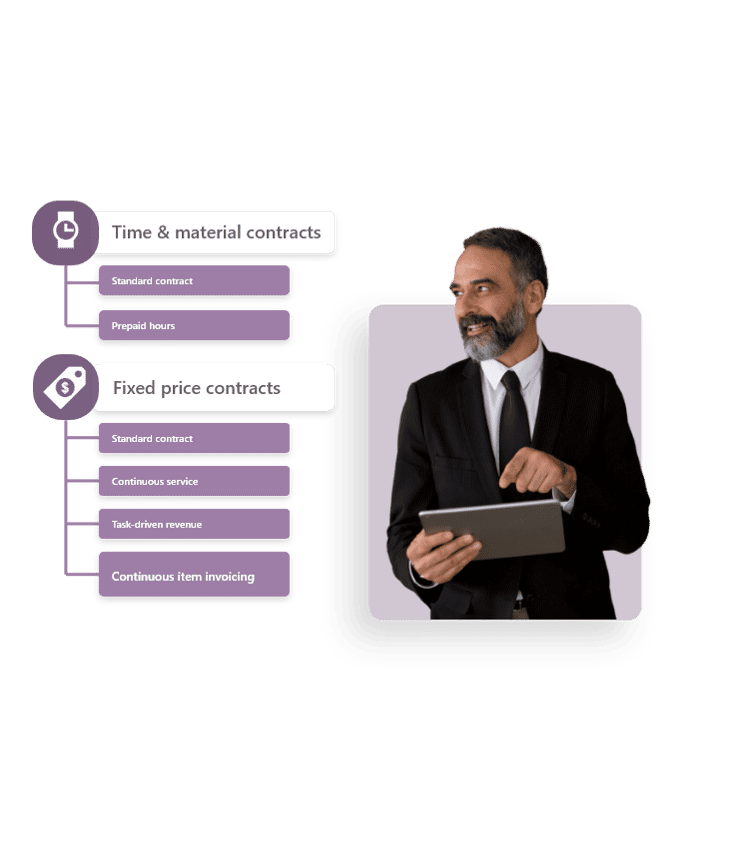

Want to learn how to handle contracts and invoice clients more accurately?

2 + 3 - Average hourly rate / realized hourly rate

If you want to know what your consultants' time is worth, there's no getting around the average hourly rate.

If you mainly deal in time & material projects, then this metric is straightforward. It's simply the rate you charge your client by the hour.

However, even though many PSOs use this metric, it should only be indicative – not as a measure of your consultants' profitability. Often, many hours are written down, so the rate does not reflect your actual work cost.

Also, it does not reveal much about the profitability of fixed-price projects, where PSOs often spend a lot of extra time finishing the job.

For this, you should look at the realized hourly rate. The realized hourly rate will tell you the actual profitability of each hour of your employees' time on any given project or client.

Caution:

None.

What is the professional services industry’s average realized hourly rate?

Get the free Maturity Benchmark from SPI Research and find out (+ all the operational KPIs relevant for the industry)

4 - Under/over coverage on projected hourly rate

This metric is handy for measuring performance on projects with a high repetition rate and a high level of experience and predictability.

The KPI measures how far below or above you are compared to a fixed hourly rate target.

Especially for businesses operating in red ocean markets with narrow profit margins, this is useful to constantly tune your business towards maximizing profitability within the parameters of your service.

It often excels in revealing hidden complexities with agreements with clients on seemingly straightforward services.

Accounting, continuous IT services, and marketing agencies that focus on optimization are examples of industries where this metric is highly relevant.

Caution:

Even though it is always relevant to set hourly rate targets, this metric is usually unsuitable for businesses with very heterogeneous project types and pricing.

Read the article: 3 reasons to build your growth strategy on processes and KPIs

5 Revenue per employee/consultant

This metric reveals whether your business is overstaffed, understaffed or right on target compared to the revenue you generate.

Typically, businesses measure this per employee (counting in all support functions) and per consultant.

Whereas the revenue per consultant will tell you the realized value of your product (your consultants' time and expertise), revenue per employee lets you know if you have the right balance between supportive staff and your "moneymakers".

Caution:

Businesses focusing too much on this KPI might not adequately consider what supportive functions you need to run an efficient and profitable company.

Optimising towards a lean organization based on this KPI can be tempting from a strictly financial perspective. But take it too far, and you risk overloading consultants with administrative work that would otherwise be done by support staff, thus eroding your consultants' value.

6 - Optimal hourly rate

Being competitive in the PSO market is just as important as being profitable. If you're not competitive, you will lose in the long run.

Finding the optimal hourly rate to charge your clients is key to competitiveness.

That being said, your consultants also need to be profitable.

To find the optimal hourly rate, you must balance factors such as the profit margin you can charge and still be competitive, your cost, your consultants' standard working time and your targeted billability %.

The formula below strictly focuses on the hourly rate based on targeted profitability and the consultants' capacity limits.

If the formula doesn't add up after you factor in the competitiveness of your hourly rate, you might need to consider the value of the service you are providing or your cost level.

Caution:

As the formula below is purely based on factors within your PSO, you must test it against the market. What are your competitors charging? How unique is your service? What are clients willing to pay?

7 - Client profitability %

Are your largest clients also the ones that yield the highest profit margins?

If you are like most companies, your largest clients probably receive most of your attention and effort. But even though they bring in a lot of revenue – they also cost a lot in terms of hours spent.

Does this show on your bottom line?

Measuring client profitability % gives you perspective on the relationship between cost and revenue on any given client.

In short, which clients yield the highest profit margins – and which are simply draining your resources?

Mapping out the most profitable customers or types of customers is crucial for developing a growing PSO with a solid bottom line.

Caution:

There can be many reasons to maintain a good relationship with high-profile clients even though their profitability percentage is low (or even negative). Some logo clients are great for references and can nudge your organization's performance.

On the other hand, large – and very profitable – clients often have exceedingly high demands that can challenge your general company strategy, especially if your company is small.

The question is: Are the profits from any one client worth derailing your company strategy in the long run?

Finance should only be part of your KPI matrix

The above 7 KPIs are just a few within the vast measurement possibilities available to PSOs today.

Only you and your team can decide what is right for your business.

Being profitable is important. However, measuring softer KPIs – for instance, employee and client satisfaction, confidence in leadership and colleagues or % of referential clients could be just as crucial for your business.

In an industry where competition for clients and consultants is fierce, many factors will impact how well your business is fairing, not just the ones that directly affect your finances.

Get an overview of your financially related KPIs

To measure financially related KPIs, you can test TimeLog for 30 days.

TimeLog is a modern PSA solution that strongly focuses on financial project management. It lets you track the profitability of consultants, projects, and clients.

You can also book a 30-minute meeting with us to discuss what KPIs could be vital for your business and how TimeLog can help you reach your goals.