You have heard about ERP, but what about PSA software?

7 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

Time tracking

Build your perfect data foundation for spotless invoicing and deep business insights with easy time tracking.

Project management

Be a world champion project manager. Keep your projects on track - and profitable.

Resource management

Efficiently staff projects and run a predictable business with confidence.

Insights & Reporting

Get smarter - faster - to make clever decisions for long-term growth impact.

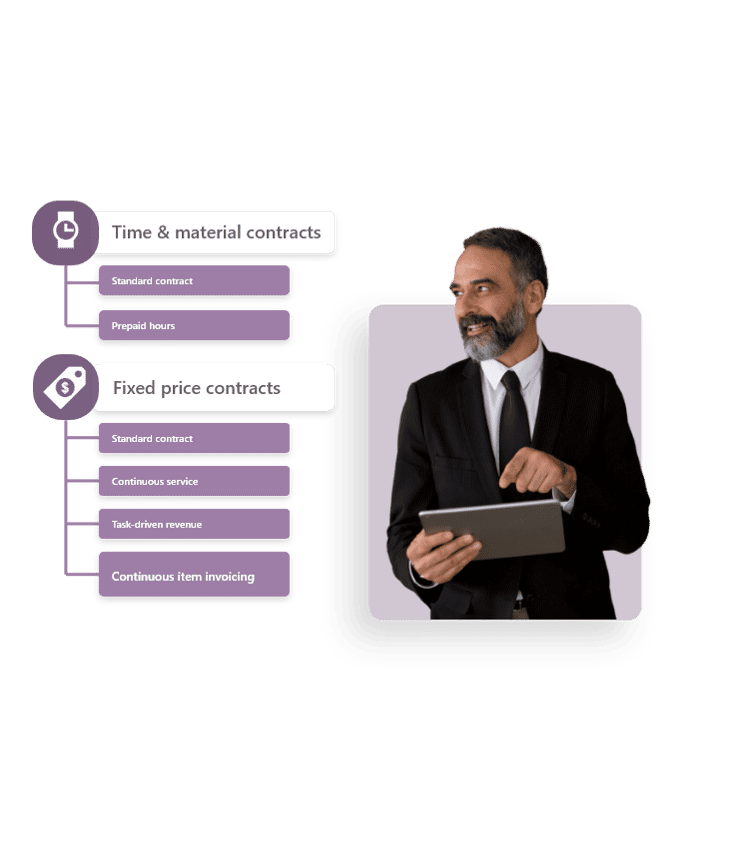

Project accounting & Invoicing

Invoice everything - fast and accurate - while staying on top of project finances.

Staff & Salary

Give accountants and HR an intelligent tool to eliminate draining administration.

Financial Systems

TimeLog offers standard integrations for all your favourite financial systems. Save time and reduce manual tasks.

Payroll Solutions

TimeLog offers standard integrations for multiple payroll solutions. Get easy salary administration and only enter payroll information once.

Add-ons

Track time automatically via Outlook, use gamification or find another add-on that can support your business.

Multiple Legal Entities

You can create synergy between your departments and across borders and offices with the Multiple Legal Entities module from TimeLog.

Business Intelligence

Utilise the insights you get from TimeLog to the fullest. Our system is ready to integrate with multiple BI solutions.

Partner Integrations

TimeLog PSA is part of a large ecosystem. Get an overview of all the partner integrations in the TimeLog family.

Economy department

Save 1-2 days a month on your invoicing process.

Project teams

From planning to execution and evaluation. Robust tools for every project manager.

Management teams

Create a performance-driven culture with solid reporting capabilities.

Large enterprises

Enhance operations and performance across entities, countries and departments.

NGOs and non-profit organisations

Simplify internal processes, spend less time on administration, and get documentation in place - at a discounted rate.

Blog

Get inspired to run an even better business with articles, guides and analyses.

Guides, podcasts and webinars

Get access to templates, guides and webinars that help and inspire you.

Help Center

Looking for help material and user guides to the TimeLog system? Look no further. Find all the help you need now.

Get a single source of truth

Discover how companies maintain a single source of truth across borders, departments, and currencies.

Get integrated

Discover the advantages customers gain from utilising our integrations and API.

Reporting in real-time

Explore how others leverage reporting to optimise their processes and make informed decisions.

Get started with resource planning

Discover how other companies thoroughly grasp their resources and enhance their ability to predict future trends.

Improved project financials

This is how the efficient financial toolbox from TimeLog helps project managers and CFOs improve their project financials.

Faster invoicing

Discover how other companies have slashed the time spent on invoicing by 75% - and uncover how you can achieve the same efficiency.

The Story of TimeLog

Get insights on TimeLog and how we can help you grow and evolve your business.

Employees

See who shows up every day to deliver the best PSA solution.

Career

What's life like at TimeLog? Are we hiring? Get the answer here.

Partner

Create even more value for your customers, as well as ours, as a TimeLog Partner.

Premium Service

Online Help Center, tailored onboarding and support from Day 1.

Corporate Social Responsibility

We work to ensure a positive impact on planet, people and businesses.

Security and GDPR

Learn more about how we work to keep your data safe and provide maximum security.

3 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it.

Running projects with the best people is excellent. If you're in a group of companies, you likely have access to a broad range of expertise across the companies.

What is not so great for many companies working in groups is the administration—getting and maintaining an overview of who borrowed which resource for which projects and how many hours you have to charge between the companies.

In this article, we examine some of the issues related to borrowing resources from each other and examine a solution that allows companies to spend less time on resource administration.

1. The different companies in our group use different time tracking systems

The first scenario is widespread. When the different companies in a group work with other time tracking solutions, any resources loaned out between companies need login details for two different systems and must make duplicate entries.

Despite the parallel data entries, the company that has loaned out its employees still doesn’t have complete control over the situation, so the company loaning the person has to report back. It’s a complicated process that naturally takes time.

Learn more about how TimeLog saves you from logging in to multiple systems and duplicating work.

This is also a common scenario in group setups. You have a giant system that deals with resource loans between group companies – but it’s still hard to work with because the system was designed for the finance department and the CFO without considering the people who have to report their hours.

Setting up the rules for loaning resources takes time, and registering the time worked by the person who was loaned out is often not user-friendly.

This was previously accepted as the norm, but more and more people are beginning to ask why they have to work in such an awful system. Moreover, it costs the company a lot of administrative time.

This scenario isn’t overly common in large groups, but also not unknown. It's inconvenient and time-consuming to administrate resource loans between companies in Excel.

If you recognise your situation in any of these three scenarios, here comes the good news: There is a way to cut down on the administration, and the solution even comes with a guaranteed return on investment (ROI).

TimeLog presents a versatile system that can handle processes such as time registration, project management and invoice processing. And the really smart aspect is that all companies in your group can use the same system, even if you work with different finance and payroll systems. This makes it incredibly easy to handle the administration associated with resource loans within the group.

You – or one of TimeLog’s consultants – can set up some simple rules for how to deal with resource loans in the system, and there are even several pre-set rules to choose from.

“Once the rules have been defined, the system takes care of everything else. For example, TimeLog automatically calculates how much income you can book to the loaned resources.”

Exactly how much time you can save by using TimeLog to administrate resource loans varies from one group to the next. But most of our major customers state that they have more than covered the cost of investing in TimeLog through saved working hours.

TimeLog also helps with more than “just” the administration resource loans between companies. For example, it provides a complete project management toolbox, and you can automate the preparation of invoices and salary payments.

Moreover, you can track your business in real-time and at different levels. How are things going for company A, company B and company C – and for the group as a whole? And how about for the individual projects? The insight and control that TimeLog offers can help you develop your group and make it even

7 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

6 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

6 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

5 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

12 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

7 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

8 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

4 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it

6 min read

Is your group is devoting inordinate amounts of time and money to administrating resource loans between companies? If so - this is what you can do about it